Two pieces worth highlighting explain the coming tax increases. The American Enterprise Institute's Alan Viard writes:

the claim that the president's plan would only take the top tax rates back to Clinton levels isn't quite right. Or, rather, it's right for only the first two years of the president's plan. Thanks to a little-known provision in the new healthcare law, the president's plan will push the top tax rates for most types of income above Clinton levels in 2013 and thereafter.

In 2010, the top income tax rate bracket for ordinary income is 35 percent. Besides wages and interest income, this income category includes profits from pass-through business firms—sole proprietorships, partnerships, and S-corporations. Under the president's proposal, the top bracket will rise to 39.6 percent. A stealth provision that phases out high-income taxpayers' itemized deductions will also be reinstated, adding another 1.2 percentage points to the effective tax rate, bringing it to 40.8 percent. Wages and some of the pass-through income will also remain subject to a 2.9 percent Medicare tax. These 40.8 and 43.7 percent tax rates, which will apply in 2011 and 2012, match the 1994 to 2000 rates—the same top bracket, stealth provision, and Medicare tax were in place then.

But the picture changes in 2013. Under the healthcare law adopted in March, the Medicare tax will rise that year, from 2.9 to 3.8 percent. Also, a new 3.8 percent tax, called the Unearned Income Medicare Contribution (UIMC), will be imposed on high-income taxpayers' interest income and most of their pass-through business income that's not subject to Medicare tax. So, under the president's proposal, virtually all of top earners' ordinary income will be taxed at 44.6 percent, starting in 2013. We're not just going back to the Clinton-era rates of 40.8 and 43.7 percent. [Emphasis ours.]

A similar pattern holds for capital gains. Under the president's plan, in 2011 and 2012, the top rate on gains, now 15 percent, will go to 20 percent, with the stealth provision adding 1.2 percentage points, sending the tax back to its 1997–2002 level of 21.2 percent. Starting in 2013, though, capital gains will also be hit by the UIMC, pushing the rate to 25.0 percent.

Dividends may, or may not, face a much steeper tax increase. If Congress does nothing, the top dividend tax rate will rise from 15 percent today to the Clinton-era effective rate of 40.8 percent in 2011 and 2012, with the UIMC pushing the rate to 44.6 percent in 2013. To his credit, though, President Obama has called for dividend tax rates 19.6 percentage points below these levels, leaving dividends taxed much more lightly than under Clinton. It remains to be seen whether congressional Democrats will go along.

Link via Economic Policies for the 21st Century.

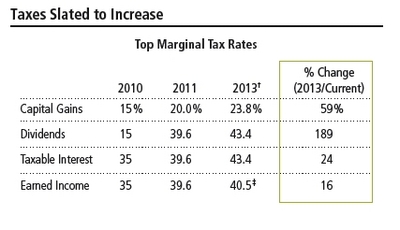

The second tax-related piece is an AllianceBernstein white paper titled Selling a Business, which includes the following nifty chart (cut it out and put it in your wallet!):

Source: Bernstein Global Wealth Management July 2010 White Paper |

AllianceBernstein draws the somewhat self-serving but perhaps nonetheless reasonable conclusion that "all else equal, an owner would be well-advised to sell in 2010 rather than later," when taxes are scheduled to go up. Who knew that one of the consequences of rising taxes would be that family-held businesses would want to sell out, usually to bigger firms that are either publicly traded or representing pension fund money? And that 189% tax increase on dividends is a doozy, especially if you put it that way. Remember when, post-Enron, the responsible politicians, regulators, and business columnists were all cheering dividends as a reliable proof of cash flow that isn't susceptible to accounting shenanigans? Now they are going to raise taxes on them 189%?